2024 Simple Ira Contribution Limits 2024 Over 55

2024 Simple Ira Contribution Limits 2024 Over 55. For 2024, if you are married and filing jointly, each spouse can make a maximum roth ira contribution of $7,000 if they have an agi (adjusted gross income). The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Let’s take a closer look at. Anyone age 50 or over is eligible for an additional catch.

Morgan Professional To Begin Planning Your 2024.

Employees who are 50 or older are also eligible to.

The Irs Released The Retirement Contribution Limits For 2024 1 And We Are Breaking It Down For You.

Fact checked by patrick villanova, cepf®.

The Contribution Limit For Individual Retirement Accounts (Iras) For The 2024 Tax Year Is $7,000.

Images References :

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, The contribution limit for individual retirement accounts (iras) for the 2024 tax year is $7,000. The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, 2024 simple ira contribution limits for over 50 beth marisa, the 401 (k) compensation limit is $345,000. Ira contribution limits for 2024.

Source: www.carboncollective.co

Source: www.carboncollective.co

IRA Contribution Limits in 2022 & 2023 Contributions & Age Limits, Employees 50 and older can make an extra. The simple ira contribution limit for 2024 is $16,000.

Source: www.bloomingumoren.com

Source: www.bloomingumoren.com

401k 2024 Contribution Limit IRA 2024 Contribution Limit, Employees who are 50 or older are also eligible to. $7,000 maximum contribution if you’re younger than 50.

Source: choosegoldira.com

Source: choosegoldira.com

ira contribution limits 2022 Choosing Your Gold IRA, The 2024 simple ira contribution limit for employees is $16,000. Fact checked by patrick villanova, cepf®.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, Maximum ira contribution 2024 over 55 free. 2024 simple ira contribution limits for over 50 beth marisa, the 401 (k) compensation limit is $345,000.

Source: directedira.com

Source: directedira.com

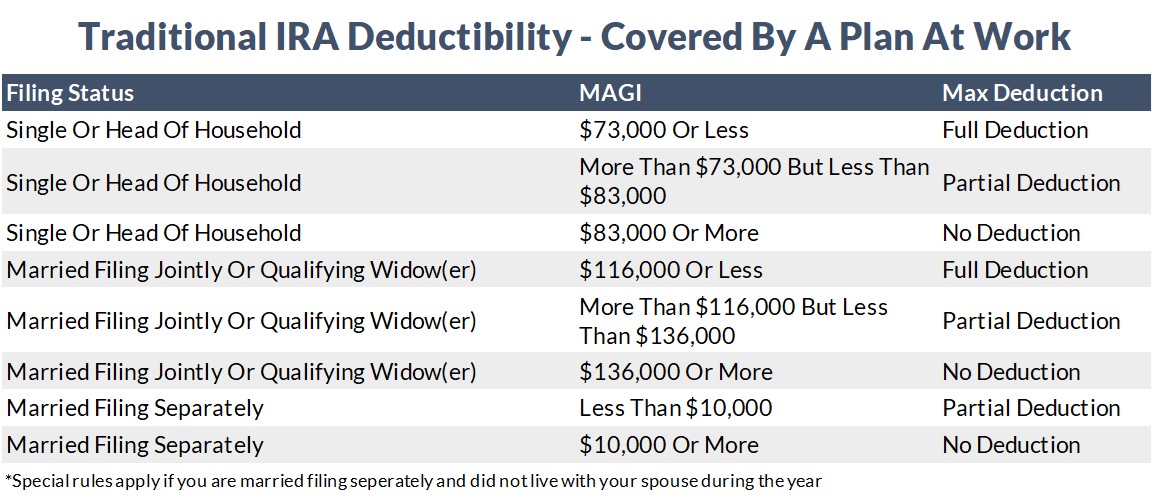

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, 2024 contribution limits announced by the irs, a person who turns 50 this year and starts contributing can sock away $128,000 in an ira by age 65, not including any investment. The maximum contribution limit for roth and traditional iras for 2024 is:

Source: inflationprotection.org

Source: inflationprotection.org

2024 ira contribution limits Inflation Protection, Employees who are 50 or older are also eligible to. For 2024, the ira contribution limit is $7,000 for those under 50.

Source: www.youtube.com

Source: www.youtube.com

2024 IRA Maximum Contribution Limits YouTube, Employees who are 50 or older are also eligible to. Fact checked by patrick villanova, cepf®.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, 2024 simple ira contribution limits for over 50 beth marisa, the 401 (k) compensation limit is $345,000. Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs.

2024 Contribution Limits Announced By The Irs, A Person Who Turns 50 This Year And Starts Contributing Can Sock Away $128,000 In An Ira By Age 65, Not Including Any Investment.

The maximum simple ira employee contribution limit is $16,000 in 2024 (an increase from $15,500 in 2023).

Employees Can Contribute Up To $23,000 To Their 401 (K) Plan For 2024 Vs.

Ira contribution limit increased for 2024.